info@exitthefamilybusiness.com

978-369-4800

Articles

Business Value

How much do you really have?

By Rick McDonald

I have never met a business owner who undervalued his or her business. I can usually determine value in about 15 minutes! I take the owner’s number and multiply by 0.7!

Your personal, investable and income producing assets are probably easy to quantify.

Not so for your business.

Many factors go into valuing a business. And in assessing a company, keep in mind what you as an owner think as the value, it does not mean that is what a buyer may pay you for the business. Value is always in the eyes of the individual, be they a buyer or owner. Each has their biases.

In general terms, buyers pay the price for the recurring revenue the business will generate. Sometimes you have the unique technology or other “intangible” assets, including cash, real estate, patents or royalties, but for most transactions, what the company generates in profits is what drives value. And giving the buyer greater confidence that what they are buying will continue (the profits) after you, the owner has departed is merely about reducing RISK. And reducing risk means a higher sale price.

The first step is to “normalize” the profit and loss statement of your company. Take out all of your salary, your perks, family members salaries that “pad” the business and are often on the books for tax reasons or family conveniences (like family plan expenses on cell phones). Take out expenditures on discretionary travel, dining, club fees and the like.

Take out the excessive rents the business pays to a related family entity. Normalized rents stay, but the excessive amount gets adjusted to represent the true nature of the cost of rents better.

We want to scrub the Income Statement by eliminating the “Seller’s Discretionary Expenses” (SDE). These expenses detract from the actual profit picture a new owner will realize, and will not continue after you have sold the business. We will, however, add back a ‘reasonable’ salary for replacing an arm’s length employee doing what the previous owner had been doing.

What we look for is Earnings Before Income, Taxes, Depreciation, and Amortization [EBITDA]. EBITDA is also called Seller’s Discretionary Earnings [SDE]. Some say SDE makes it easier to relate. Either way, this is an accurate measure of what a buyer is “buying.”

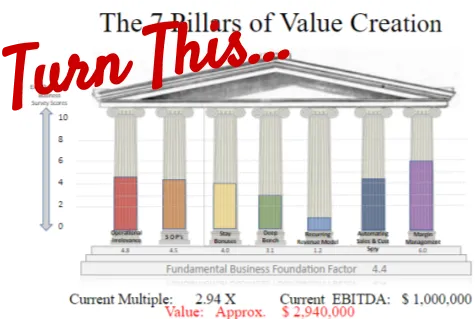

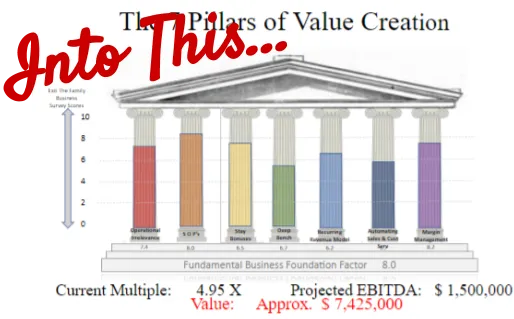

Now, given how the business is managed, customer base, diversification of customers, economic environment, and size of sales/EBITDA, a multiple of EBITDA is applied typically ranging from 3 or 4 to as high as 6, depending upon the business in question.

If you want to discover how managing your EBITDA and the '7 Pillars of Value Creation' can help you, it starts by taking our Saleability Survey. Your score determines your current position, and then we can show you EXACTLY where you need help to increase the value of your business.

How It Works

It's time to face the truth. If you don't plan your exit correctly, you could end up working until you die. Your journey to a successful sale and increasing the value of your business by 30-50% starts with taking our Exit Valuation Survey. This tells us exactly where you are now, the exact performance of your business, and what you need to do to improve. You can access your buyer Risk Report and speak to our analyst team on a complimentary call to discuss your results, increasing value and exit options.

TAKE THE SURVEY

Discover how your business scores in

the 7 key drivers of valuation

ACCESS RESULTS & ANALYST

Understand the risks a buyer sees

when valuing your specific business

INCREASE BUSINESS VALUE

Implement the "7 Pillars Of Value Creation" and increase your business value

*The Lower Middle Market is comprised of businesses worth $5-$30 million, typically having EBITDA of $1 million - $4 million.

The 7 Pillars of Value Creation is our name for our work as Business brokerage services and related consulting pertaining to business sales, mergers, acquisitions and business valuation. Exit The Family Business the downloadable guide and any accompanying assets or affiliates are provided for informational and educational purposes only. It is not intended to provide tax, accounting or legal advice, nor is it an offer or solicitation to buy or sell, an endorsement or sponsorship of any company, security or fund. Certain owners, officers or affiliates may be associated with investment firms and may make referrals from time to time for such services, but this does not constitute investment advice, nor should it be construed as Exit The Family Business being in that business. We always suggest you seek professional advice. Past results are not a guarantee of future results.