info@exitthefamilybusiness.com

978-369-4800

Case Study - Jack & His $4.3M $8M Sale

Meet Jack

Our Case Study Client

Jack built NE Offset Printers, Inc. 31 years ago. At age 67, it just plain hit him. He was tired. He needed out. Things seemed good and he did not want to go through another 2008-2010. And his wife wanted to travel, and not just to an annual trade show in Florida…

Life was good. Kids were “sort” of off on their own. He took out $300,000 before the “perks”, which probably totaled another $100,000 when you counted helping his daughter (single, divorced mother), travel/vacation with his wife, the cars, & generous expense reimbursements.

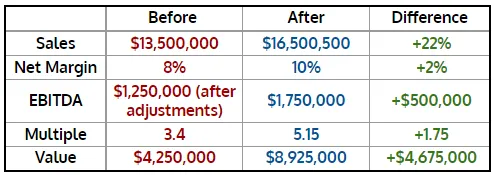

The company had top-line revenue of $13,500,000 and with an 8% net margin, his accountant told him his adjusted EBITDA actually ran around $1,250,000. When he had a valuation conducted, his market value came in around $4.1 – $4.3 million, assuming a 3.3 to 3.5 Multiple. His accountant told him $4.5 Million was comparable to a couple of sales he was ‘aware of”, recently.

The problem was at $4,500,000 Jack could expect transactions costs of about $200,000 - $250,000 and taxes of $1,000,000, leaving him with a net of around $3,00,000 - $3,250,000. With personal savings not exceeding $100,000, and retirement assets around $600,000, Jack was pretty clear his lifestyle was going to take a pretty big hit. He had made promises to assist grandkids (4) in college, and he still worried about his daughter’s future and his ability to be her backstop.

So he worried about a sale, his health, the business economy as well as the investment horizon after a long bull market, and the suspicion that taxes may only go up in the near future…

He was between a rock and a hard place.

Until he ran into a workshop dealing with business exit strategies and “Value Creation".

What intrigued Jack was the simple truth: He had been running the company as a “Lifestyle Owner” for several years. He recognized himself in the talk. He also knew he was not running the company as lean and competitively as he could have been & reinvesting in infrastructure had slowed in recent years.

He also thought he had a good Operations Manager. She was very well paid, was always rushing around with the Sales team, and was seemingly quick to show him whatever report he might ask for. All in all, he thought things were running smoothly. He had grown somewhat apart from his larger customers, but sales were growing at an 8-10% rate and he was satisfied.

ENTER ETFB

Our Input

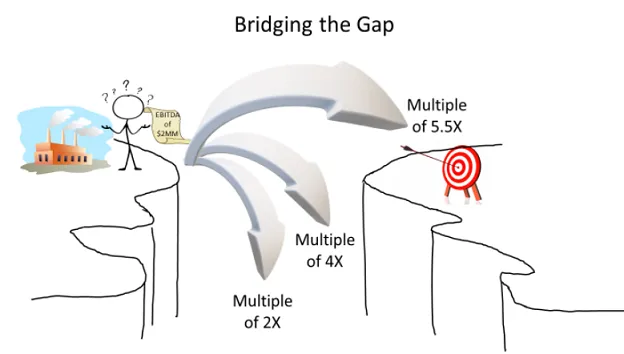

So Jack engaged the Private Equity firm “Exit The Family Business” to produce the 7 Pillars Report, which confirmed his Multiple was in the mid 3’s (in a fraction of the time it took his accountant!). He realized he was not going to be able to retire on his own terms unless he more than doubled sales, which probably was unlikely.

The Exit team identified a Multiple of the low to mid 5’s was where he needed to be. What he learned was a bit of earnings growth and boosting the Multiple from mid 3’s to 5-ish would bridge the gap to his objective of getting a price where he could net enough capital to meet his financial goals.

“Exit” prepared a full audit on the company, looking at the business in the eyes of a Buyer. A number of things became apparent, notably:

- There was more than a little friction between the Operations Manager and the sales team, where she had a financial incentive on their commissions, and it was suggested she had a bias as to feeding new leads to a favored salesperson. While nothing was said directly, a conflict of interest was clearly a shared concern.

- Margins were softer than industry averages.

- The sales focus seemed to be after new business and not spending time with large, national companies, investigating what new lines they may be able to serve. There was an issue over “company accounts” v. new business and how commissions were treated with an expansion of house accounts.

- It was clear the Operations Manager had her fingers into everything, and there was not a lot of clarity as to supervision and reporting chain of command.

- In house accounting systems and customer service reports were antiquated.

- The head pressman had ideas he felt no one cared that much to listen to, and he was aware of reasonably inexpensive technology breakthroughs others in the trade were utilizing that could ensure a better quality of color separations and improve both quality and time on run rates.

By referring to the 7 Pillar Report, the Exit planning team and Jack were able to define several clear, measurable goals that would materially improve on the Multiple.

1.

Operational Irrelevancy

Make Jack the Chairman and promote the Operations Manager to President. Along with that, she got a raise and no longer had a financial interest in the sales channel. She also was given a financial interest in a successful sale above a certain benchmark (6% bonus on the sale of the company in excess of $4 million). She was clear Jack was serious in selling, and now she understood the importance (to her) to assist in a successful transaction.

The head Pressman, who had been with the company for 23 years, was made Plant Operations manager, reporting to the new President.

Jack’s new role was to meet with all national accounts and explore deeper market penetration into other product lines these existing customers had in-house and geographically positioned to be served by Jack’s company.

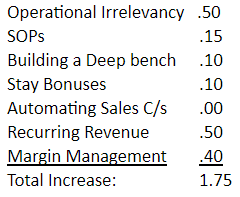

By making this move, the impact on Operational Irrelevancy added .50 to the overall Multiple.

2.

Standard Operating Procedures

All key personnel, from the Plant Manager, Accounting and Administration head, and the President developed specific Standard Operating Procedures protocol defining each task they were responsible for, how it was to be accomplished, who supported them, and who they, in turn, reported to, and how often.

Along with achieving clarity in the overall process, morale was increased and people felt better listened to and supported.

By creating specific job descriptions and procedures, this added .15 to the Multiple.

3.

Building A Deep Bench

With the restructuring and promotion of team members, a clear bench was created, giving a prospective buyer a sense of continuity of the business after the owner has departed.

This action added .1 to the Multiple.

4.

Stay Bonuses

Jack had made his desire to sell the business clear to all members of the team. He also sat down with his new President and Plant Manager and Head of Administration and explained he likely would be required to have a holdback for a period of time, as a requirement by the buyer. He explained he expected this would be for a period of 12 months, though this, of course, had yet to be determined. He explained that upon his receiving this holdback, each of them would receive a bonus of 75% of there current salary, paid by him, as long as they were in good standing with the potential, future buyer.

This action added .10 to the Multiple.

5.

Automated Sales & Customer Service

While important, this area was not thought to be a large factor in increasing the Multiple. Jack did allow updating of a CRM system, billing and inventory control.

This action was generally felt positive to a Buyer’s sense of comfort but was not anticipated to add to the Multiple. It was more defensive in nature, as it was seen as something that should be present but was not up to speed. Little to no benefit to the Multiple was expected by this action. Important, yes, but it was not thought to be “a low hanging fruit”. But again, this would contribute to a Buyer’s sense of confidence in the numbers, as well as the overall feel that the business is running well, and the net earnings should be sustainable. This is the main objective all sellers must strive for.

6.

Recurring Revenue

While not explicitly recurring revenue, an analysis of sales indicated the company probably had as much potential increasing the gross sales with existing customers as it did with the generating of new clients. This would dramatically lower CAC (Customer Acquisition Costs) should this be proven true.

Jack spearheaded a new program with inducements for price savings for national accounts entering into multiple lines of product sales. This proved to be very favorably received, and led to 3 new markets within 3 existing national accounts, increasing overall sales by 22% in the first 9 months of implementation.

Further sales opportunities seemed to be available, which led to the strategy of creating a second shift, should a buyer wish to develop this business to the next level. By receiving letters of interest from these national players, this dramatically increased the growth potential of the business, on paper.

This growth increased the top line sales by 22%, from $13,500,000 to approximately $16,500,000.

This also created a closer relationship with these key customers than ever before and jack created both a financial as well as a strategic relationship with them, which in turn resulted in the signing of long term contracts, something that was difficult at best, prior to this change. This action had the impact of adding to the Multiple by .5.

7.

Margin Management

Margins changed for various reasons.

CAC expense for $3 million in sales dropped as Jack was essentially the “salesperson. Only a customer service representative cost had to be allocated to this new block of business.

The Plant manager was able to improve Quality, Capacity and Efficiency at the press levels with capital expenses of less than $70,000.

Overall customer service increased, as did A/R being reduced by 12 days.

Overall, this had the effect of increasing Net Margins from 8% to 10%, the industry target. This had the impact of adding .4 to the Multiple.

WHAT NEXT?

Happy Bonus

One unintended consequence of all the changes was that sales increased by 8% over projections, essentially thought to due to clarity in the commission schedules and removing any perceived conflict from the “new” President.

1. Overall, Gross Sales increased from $13,500,000 to approximately $17,500,000, 22% due to new sales from existing customers, and 6% above projections from the sales team on new business of their own.

2 . EBITDA grew from 8% on $13,500,000, or $1,080,000* to 10% on $1750,000,000 or $1,750,000.

3. Multiples grew from 3.4X to 5.15X - an addition comprised of:

OLD VALUATION

$13,500,000 w/ 8% Net Income = EBITDA of $1080,000.

After “adjustments”, approximately $1,250,000

Multiple of 3.4X

Company Prospective Value to a Buyer: $4,250,000.

NEW VALUATION

$1,750,000 w/ 10% Net Income = EBITDA of $1,750,000.

No further “adjustments”.

Multiple of 5.15X

Company Prospective Value to a Buyer: $8,925,000.

“I have known Rick for over 20 years, as a wealth manager, business owner and business coach. He understands value creation and consistently applies his knowledge with business owners, helping them to unlock value and bring the company to market. He is simply one of the best in the business! Use him. Follow his advice! You will be glad with the magic he creates in helping your family business increase in value as you approach selling the company”. Rob Slee 2019.

Business sale and continuation advice you can count on!

Business sale and continuation advice you can count on

When it comes to selling your family business, the financial implications, employee responsibilities and emotional turmoil can be daunting. At U.S. Advisory Group, we do the hard work for you.

When it comes to selling your family business, the financial implications, employee responsibilities and emotional turmoil can be daunting. To ensure your business can successfully continue without you, and if you want to make it sustainable for your family or key employees to take over, let the Family Business Project team do the hard work for you.

The Complete Package

We look at your entire business and personal needs to provide professional, holistic advice, helping you achieve your desired outcome and increase your business value.

Your Personal Wealth

We don't just work with your business. Nearly everyone is concerned about running out of money, but we'll help increase your wealth outside of the business.

Improve Your Business

As part of our services, we provide operating procedures that helps to not only provide recurring revenue models, but also makes the business saleable.

Finding The Right Buyer

Whether you are looking to sell to a family member, employee or a stranger, our specialist services will ensure you get the best deal & price so we can reduce your worry.

Minimizing Taxes

Without the proper assistance, you could look to pay up to 40% in taxes, plus another 4-5% in legal, advisory & accounting fees. We'll help you keep your tax bill at it's minimum

Maximize Your Sale

Selling a business incurs a lot of financial strain and effort to keep it's value sustainable. Implementing procedures and having key employees help justify a higher sale

How It Works

You might be ready to sell your business due to your age, health or financial needs but that doesn't mean your business is ready to be sold!

We provide an easy-to-follow strategic planning process that enables you to take your business from an income generator to a saleable asset. With an average increase in the business value of 50%!!

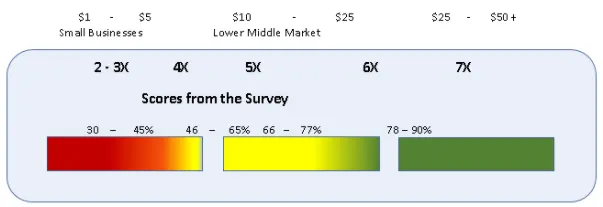

TAKE THE SURVEY

Discover how your business scores in

the 7 key drivers of valuation

ACCESS RESULTS & ANALYST

Understand the risks a buyer sees

when valuing your specific business

INCREASE BUSINESS VALUE

Implement the "7 Pillars Of Value Creation" and increase your business value

*The Lower Middle Market is comprised of businesses worth $5-$30 million, typically having EBITDA of $1 million - $4 million.

The 7 Pillars of Value Creation is our name for our work as Business brokerage services and related consulting pertaining to business sales, mergers, acquisitions and business valuation. Exit The Family Business the downloadable guide and any accompanying assets or affiliates are provided for informational and educational purposes only. It is not intended to provide tax, accounting or legal advice, nor is it an offer or solicitation to buy or sell, an endorsement or sponsorship of any company, security or fund. Certain owners, officers or affiliates may be associated with investment firms and may make referrals from time to time for such services, but this does not constitute investment advice, nor should it be construed as Exit The Family Business being in that business. We always suggest you seek professional advice. Past results are not a guarantee of future results.