info@exitthefamilybusiness.com

978-369-4800

Articles

Understanding Multiples

The Secret Sauce in Creating Value

By Rick McDonald

In its simplest meaning, a Multiple is simply a figure applied to the “free cash flow” within your business that reflects the confidence a buyer has that the cash flow will not decrease.

Or even better, may increase after they have bought the company and you, the founder/owner, have departed (or at least no longer “own” the company). This is then multiplied by your business’ EBITDA for the business value.

To get a realistic expectation of your Multiple you need to know how it is developed.

It’s important to understand that the “cost of capital” affects what a buyer may pay for a $1 profit. So that means interest rates affect Multiples.

So does supply and demand. Today, there is an abundance of Private Equity money waiting to be deployed and the pressure to deploy this capital is immense.

No Private Equity fund wants 60% of its raised capital working hard, and 40% sitting in cash diluting overall returns to its investors. They need that money put to work, thus putting upward pressure on Multiples at the moment.

And most importantly, the quality of a company affects the Multiple a buyer will use in determining valuation.

The lower the risk to the free cash flow they are purchasing, the higher the Multiple they will use in assessing valuation.

Growth and the growth potential of companies also affect the range of Multiples a company will have.

The size of a company is also a factor. The larger the company, the more diverse the risk factors are, and thus a buyer has more confidence the cash flow will not be disrupted by any one business component.

This includes the depth and breadth of the management team, and in most cases, the diversity of customers, reducing the reliance on any one customer.

So, the larger the business, the larger the Multiple.

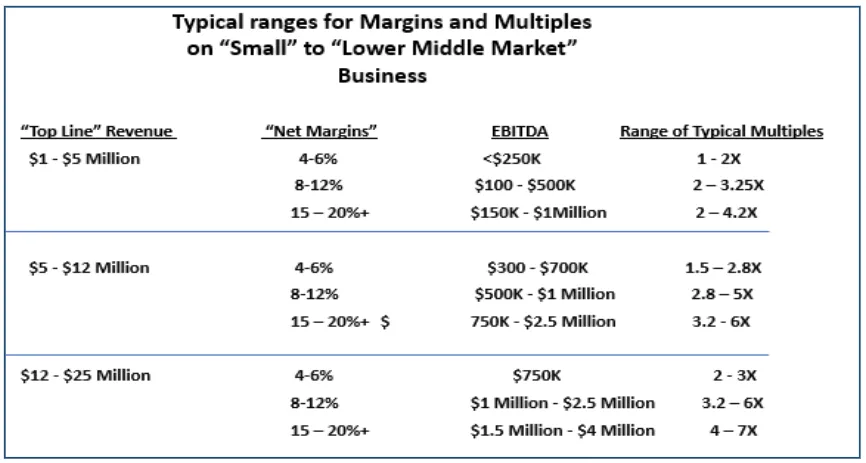

For example, small businesses expect a Multiple in the 2 to 4 range, lower middle-market companies expect Multiples between 4 to 7. Middle market companies expect Multiples to be in the 8 to 12 area, large private companies may see a range of 12 to 15, and larger, publicly traded companies are often found in the 18 to low 20 range.

So the key to increasing value, particularly in the lower end of the lower middle market business (running the gamut from the $5 or $6 Million to the $20 or the $25 Million business) is to increase your Multiple. If you position the business correctly, you will attract buyers willing to use the higher range Multiple in your space. It’s simply financial leverage.

Increasing the Multiple by 1 or even 2 is like doubling your sales - and moving the Multiple is likely much more realistic than doubling your sales!

Here’s what this looks like for this market segment:

So the first order of business is to understand how a Buyer (NOT you!) views your business. Get into the habit of looking at your business objectively, from the outside in.

Understand the risks a buyer perceives in your business, then go to work on the areas of greatest concern. Have the specific goal of creating a realistic case for a Buyer utilizing the higher end range of a Multiple applicable to your size business, its EBITDA and its growth prospects.

Do that, and the value of your business can be increased by 30 to 50% or even more!

Remember to get your copy of the book: “Exit The Family Business”. It walks you through exactly what you need to do to increase the value of your business and be prepared for the transaction of your dreams.

Plus take our 10-minute Exit Valuation Survey to see the current status of your business and how prepared you are for a sale.

How It Works

It's time to face the truth. If you don't plan your exit correctly, you could end up working until you die. Your journey to a successful sale and increasing the value of your business by 30-50% starts with taking our Exit Valuation Survey. This tells us exactly where you are now, the exact performance of your business, and what you need to do to improve. You can access your buyer Risk Report and speak to our analyst team on a complimentary call to discuss your results, increasing value and exit options.

TAKE THE SURVEY

Discover how your business scores in

the 7 key drivers of valuation

ACCESS RESULTS & ANALYST

Understand the risks a buyer sees

when valuing your specific business

INCREASE BUSINESS VALUE

Implement the "7 Pillars Of Value Creation" and increase your business value

*The Lower Middle Market is comprised of businesses worth $5-$30 million, typically having EBITDA of $1 million - $4 million.

The 7 Pillars of Value Creation is our name for our work as Business brokerage services and related consulting pertaining to business sales, mergers, acquisitions and business valuation. Exit The Family Business the downloadable guide and any accompanying assets or affiliates are provided for informational and educational purposes only. It is not intended to provide tax, accounting or legal advice, nor is it an offer or solicitation to buy or sell, an endorsement or sponsorship of any company, security or fund. Certain owners, officers or affiliates may be associated with investment firms and may make referrals from time to time for such services, but this does not constitute investment advice, nor should it be construed as Exit The Family Business being in that business. We always suggest you seek professional advice. Past results are not a guarantee of future results.