info@exitthefamilybusiness.com

978-369-4800

Articles

What is going on with the Workforce in the Lower Middle Marketplace?

By Rick McDonald

A lot of clients, folks who own, manage and operate “Lower Middle Market” (LLM) companies – the economic engine for US employment struggle to find, train, and retain good employees, especially in the “trades”.

There are a couple of significant events going on out there…

In the big picture, the U.S. economy is continuing to create a lot of jobs, but the growing workforce isn’t producing a bigger gross domestic product. It’s worrisome, so what exactly is going on?

First, the good news: In June, the number of people on nonfarm payrolls in the United States increased by 372,000, more than expected. More jobs, more income — that’s positive.

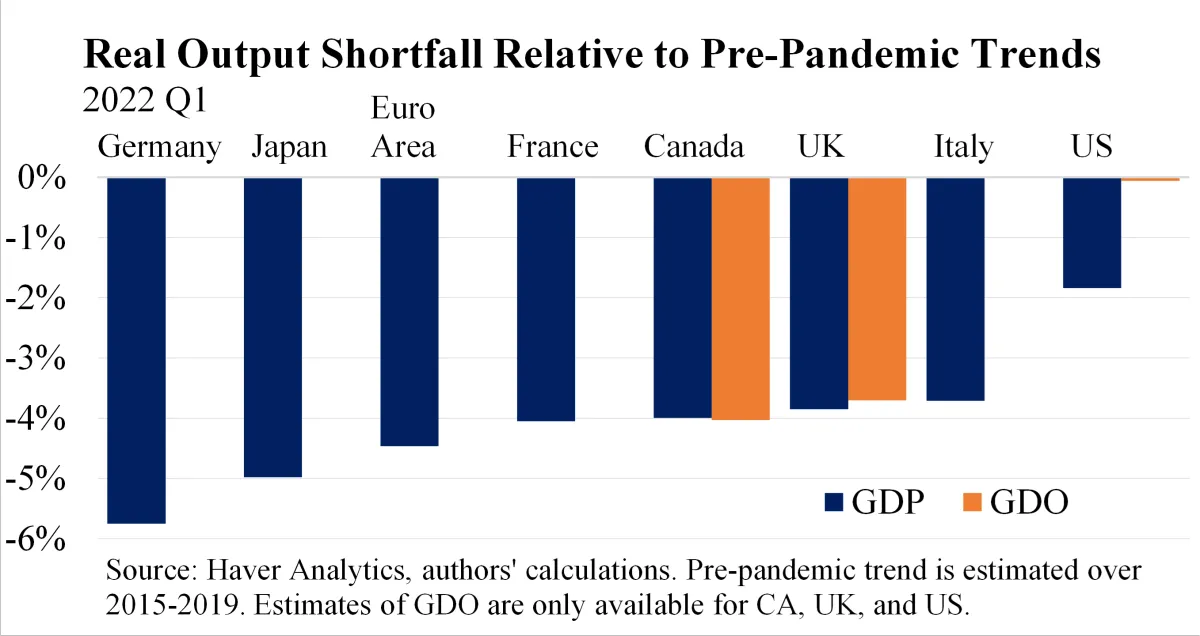

What’s not so good is that the economy seems to require so many more workers at a time when its output is actually shrinking. The output of goods and services fell at an annual rate of 1.6 percent in the first quarter of 2022, and according to the Home Treasury, 1.8 percent below trend.

It probably fell at a 1.2 percent rate in the just-ended second quarter, according to the G.D.P. tracker of the Federal Reserve Bank of Atlanta.

More people producing less is not a good look, no matter how you squint. Labor productivity — that’s output per hour of work — shrank at an annual rate of 7.3 percent in the first quarter in the nonfarm business sector. Given what we know about jobs and output, productivity probably shrank again, though less, in the second quarter.

It’s clear now, that most of the increase in jobs was from a change in the mix of workers. Huge layoffs in leisure, hospitality, and other low-wage sectors early in the pandemic skewed the labor force toward workers who earn higher wages and tend to have higher labor productivity (at least as conventionally measured).

So, why does the LLM business owner care?

The temporary skew in the average skill level of jobs accounted for 71 percent of labor productivity growth in the second quarter of 2020. Now all these so-called lower-skilled employees are back but being retrained in higher-paying jobs due to this shift. Thus, a shortfall in trained, skilled employees in the manufacturing industry.

Strong demand for workers has forced owners to bring less productive workers that in normal circumstances would not be active or employed, thus productivity suffers. Meanwhile, employment won’t remain strong for long if employers sense that the strength of demand for their goods or services doesn’t justify all the hiring they’ve been doing. Some of the hiring reflected in the strong June jobs numbers is the result of decisions made months earlier when economic prospects were brighter.

Winning companies will respond to the slump by investing more in automation, while ambitious workers will switch to employers “who can afford to pay more but who will also require them to be more productive”.

Adding insult to injury, we are seeing strong evidence of “national firms” rolling up LLM companies for their employees, as well as aggressively seeking out skilled labor to these larger rollups with higher pay, and better benefits (with the expectation of generating higher productivity through economies of scale). This trend creates additional pressure for the Lower Middle Market owner to compete for good help.

When the output is weak while input is strong, it means businesses’ costs are rising and profits are getting squeezed, which tends to lead to layoffs. Profits have been lately providing a cushion. But productivity is on track for one of its worst 12-month performances in records going back to 1947. Look out below.

How It Works

It's time to face the truth. If you don't plan your exit correctly, you could end up working until you die. Your journey to a successful sale and increasing the value of your business by 30-50% starts with taking our Exit Valuation Survey. This tells us exactly where you are now, the exact performance of your business, and what you need to do to improve. You can access your buyer Risk Report and speak to our analyst team on a complimentary call to discuss your results, increasing value and exit options.

TAKE THE SURVEY

Discover how your business scores in

the 7 key drivers of valuation

ACCESS RESULTS & ANALYST

Understand the risks a buyer sees

when valuing your specific business

INCREASE BUSINESS VALUE

Implement the "7 Pillars Of Value Creation" and increase your business value

*The Lower Middle Market is comprised of businesses worth $5-$30 million, typically having EBITDA of $1 million - $4 million.

The 7 Pillars of Value Creation is our name for our work as Business brokerage services and related consulting pertaining to business sales, mergers, acquisitions and business valuation. Exit The Family Business the downloadable guide and any accompanying assets or affiliates are provided for informational and educational purposes only. It is not intended to provide tax, accounting or legal advice, nor is it an offer or solicitation to buy or sell, an endorsement or sponsorship of any company, security or fund. Certain owners, officers or affiliates may be associated with investment firms and may make referrals from time to time for such services, but this does not constitute investment advice, nor should it be construed as Exit The Family Business being in that business. We always suggest you seek professional advice. Past results are not a guarantee of future results.